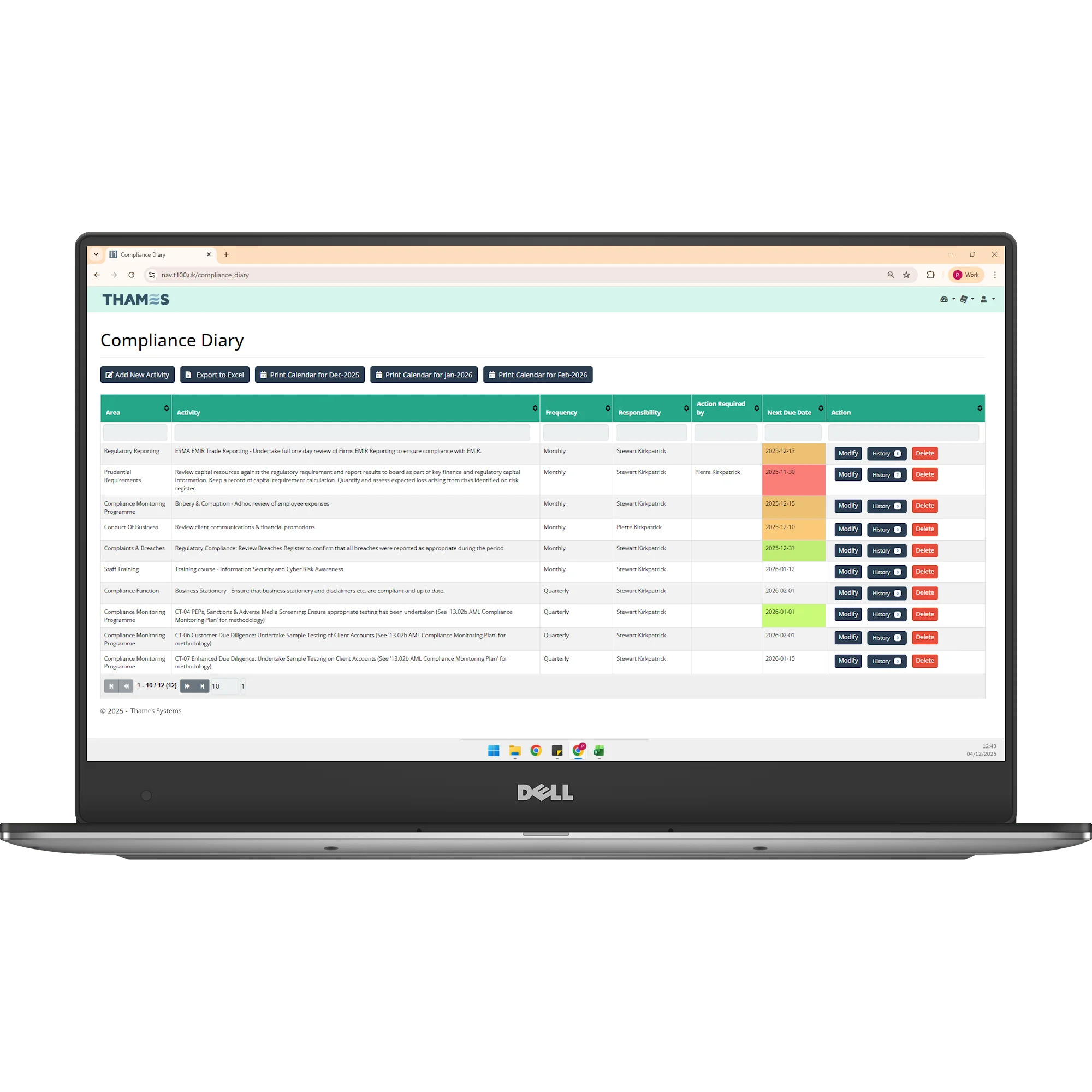

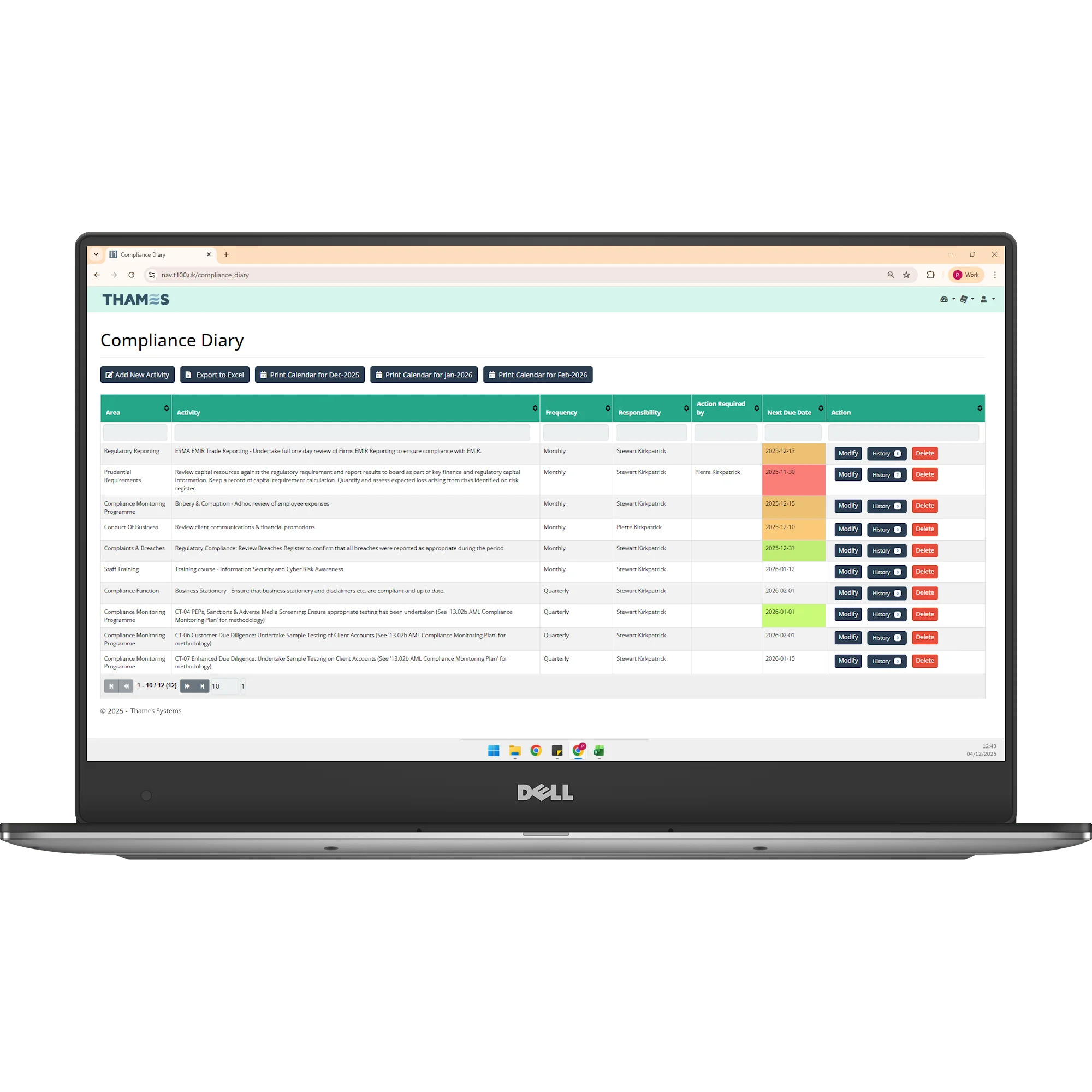

Compliance Diary

The Compliance Diary within the T100 system transforms passive record-keeping into an active and auditable governance framework, ensuring your firm is always prepared for regulatory scrutiny.

This feature is the foundation of transparent and defensible compliance operations.

The T100 Compliance Diary

Your Engine for Audit-Ready Accountability

Beyond simple task lists, the Compliance Diary transforms regulatory obligations into an auditable, efficient workflow. This is where accountability meets digital defense, ensuring your firm maintains a bulletproof compliance posture.

Proactive Alert Management

Centralized Products Database

Global Client Risk Mapping

Daily Cash Movement Reporting

Compliance Benefit & Key Features

Clear Delegation & Workflow

Assign specific compliance responsibilities to team members. The system manages the hand off from junior staff performing legwork to senior officers providing final authorization and sign-off.

Mandatory Audit Defense

Every activity requires clear documentation that details what was done, how it was done, and when it was completed. This creates a secure, court-ready evidence trail for auditors.

Historical Record-Keeping

The diary retains a full, searchable history of all actions and sign-off dates. Even if staff change roles, the institutional memory remains intact, preventing compliance gaps.

Issue Resolution Tracking

When an issue or alert is flagged, the diary ensures progress is meticulously tracked. You can see precisely which steps were taken to resolve the issue, leading to final closure.

Proactive Risk Monitoring & Data Power

The T100 system doesn’t just record history; it actively monitors live data to shield your firm from compliance breaches and external risk factors, all while simplifying complex reporting requirements.

Live Monitoring & Automated Protection

T100’s continuous checks transform compliance from a reactive duty into a proactive defense system.

Daily Sanity Checks: The system runs automated consistency checks (sanity checks) every morning at 6:00 AM, scanning all trading and account data for predetermined anomalies or breaches of regulatory parameters.

Instant Alert System: When a breach is detected, the system immediately raises an alert, categorizing it using a traffic light system for instant prioritization:

🔴 Red Alerts

Indicate overdue or high-priority issues requiring immediate action.

🟡 Amber Alerts

Signify issues that have been noted but are not yet addressed.